(A non-technical analysis)

To explore why Bitcoin has value, we first must define what monetary value is in the first place.

Money. It’s actually a very odd thing. Our entire lives revolve around it and yet very few people even bother to ask the important questions about what it is or how it is supposed to work.

To explore this, we must first imagine living in a world where money doesn’t exist. We know this as a barter/trade society which has existed in many periods throughout history and even today in some parts of the world. In a pure barter driven economy, objects and services are directly traded for each other. I may give you oranges in return for a jacket. A barber will give someone a haircut in return for a sandwich. Someone else may trade a TV to a skilled mechanic in exchange for fixing their car. This certainly works to a degree, but is not efficient and quickly creates a lot of problems. How many chickens is a fair trade for a TV? What is the value of a haircut in relation to an orange or fixing a car? It becomes clear that something needs to be created independently to represent the value of everything else. A common denominator is necessary because it becomes impossible to keep track of how many chickens are worth trading for a bicycle. Money functions as a device which allows us to compare everything back to the same universal standard.

Money is essentially a technology that communicates relative value. Think of it as a common language that is spoken between two or more people that communicates what something is worth based on the current market value of it. Especially since values can change so frequently due to fluctuating supply and demand, money is the most efficient way for us to easily compare all goods and services against all other goods and services. Many things can and have been used as money that attempt to solve this barter problem. Cigarettes are used as money in a prison. The Native Americans used beads. Older cultures used stones or even salt as forms of money. But just like any other technology or solution, some of these ideas may work better than others which leads us to the most important questions:

How do we determine what makes good money? What exactly determines a good store of value??

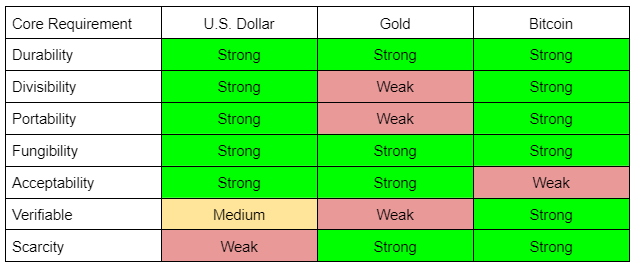

To answer these questions, there is an established set of properties that all good money must obey. Money must comply with as many of these requirements as possible to effectively solve the raw problems of barter and trade. The better the money complies with these rules, the better the money can function and do its job.

Durability:

Money needs to stay the same over time. Durability is the hardness that allows it to last a long time. Ideally, money essentially works like a battery. We perform a job to provide a product or service to someone in return for some economic energy that we can store and exchange for later use. If our money degrades over time, loses value, or can be counterfeited, the economic value and effort used to initially acquire it becomes lost.

| U.S. Dollar | Gold | Bitcoin |

| The dollar as we currently use it is an abstract concept which does not physically degrade. Physical paper money can degrade over time, but the fundamental idea of a dollar which it represents remains constant. | Gold is a very special element on the periodic table that doesn’t corrode or rust over time. It maintains its physical properties for millions of years. | Bitcoin is not physical so it does not rust or spoil. It exists as an electronic entry in a distributed ledger that cannot be contaminated or change in nature over time. |

| Strong | Strong | Strong |

Divisibility:

Money needs the ability to be divided and combined into both smaller and larger units. This breakdown provides the ability to represent both the largest and smallest amounts of the economic energy it represents. It provides a way to allow the measurement of value to be much more accurate for economic transactions of any size.

| U.S. Dollar | Gold | Bitcoin |

| The dollar is divisible into cents for smaller units. In some cases even fractions of a cent can be used to provide the most accurate representation of economic energy. | While gold can of course be forged into different sizes of coins and bars, it is not easy to create tiny units to accurately represent true value. Counting pebbles of different sizes, dust, or flakes is not practical or accurate when performing most transactions. | Much like cents to the dollar, there are 100,000,000 satoshis to a single full “coin”. And because it is digital, even smaller units can be made available when necessary. |

| Strong | Weak | Strong |

Portability:

Money and value needs to come with us as we travel. We need to be able to move, send, and transport it efficiently with as little effort as possible.

| U.S. Dollar | Gold | Bitcoin |

| The dollar is relatively portable in both digital and physical forms. As long as we have access to our modern digital payment networks and the required help of our banking system, we can potentially transport it and efficiently move it around. (As long as the banks and government permit of course.) Paper money backed by gold was actually an attempt to solve gold’s portability problems. | Gold is extremely heavy and cumbersome to move especially in large amounts. It is not efficient to transport or store. Portability is one of the primary reasons gold failed to survive in a modern high velocity economy. Because it still meets other requirements so well, it continues to function as a fantastic store of value and always will. | Bitcoin is purely digital so it has no weight or mass. It can be transmitted anywhere in the world through a globally connected network. Any amount can be transmitted instantly with the same physical effort and efficiency as an email or text message. |

| Strong | Weak | Strong |

Fungibility:

Money needs to be consistent within and throughout its makeup. One unit must be exactly equivalent to another. This creates a uniform platform to make the exchange of value consistent any time a unit is used. For example, seashells or beads could be used as a form of money, but some beads may be slightly different in size, quality, shape, or color which would create an inconsistent unit of measurement.

| U.S. Dollar | Gold | Bitcoin |

| A dollar will always be equal to a dollar no matter which one. The relative value may not be consistent, but because it is abstract, the uniform nature of all U.S. dollars everywhere makes it fungible. | Broken down to a raw earth element, a small fraction of gold has the same properties and is uniform in nature to a gold coin or bar. It maintains the same properties no matter the amount, shape, or size. | There is no difference when comparing one satoshi to another. They are all equal in definition, functionality, and value. |

| Strong | Strong | Strong |

Acceptability:

To maximize economic outreach, money and value needs to be recognized as such by as many people as possible participating in the network. To replace the inherent varied nature of a pure barter system, everyone participating in the economy must agree on the same common denominator. The more people that agree on that foundation, the more that chosen money will be recognized and accepted within that economy.

| U.S. Dollar | Gold | Bitcoin |

| The U.S. dollar is extremely well accepted in most if not all places in the world. It has become what we know as the world reserve currency simply because the vast majority of the world’s population has accepted it as such. | Gold has been recognized as having value for thousands of years. Everyone knows what it is, everyone wants it. Even if you are performing an economic transaction with someone you have never met, it is a safe bet that they would recognize and accept gold as a payment. | Not everyone accepts or recognizes Bitcoin. (Yet…) However, the network is continuing to expand at an exponential rate. As it grows and adoption increases, it is quickly becoming more recognized and accepted all over the world. |

| Strong | Strong | Weak (But Growing) |

Verifiable:

Money must be authentic and easily verified as the real thing. If money can be counterfeited, that is an immediate threat to the scarcity and directly undermines the value. The speed at which it can be verified is also critical to consider as well.

| U.S. Dollar | Gold | Bitcoin |

| We trust that our digital dollar transactions are verified through our various payment networks and banking systems. However, physical dollars can be counterfeited which poses a potential weakness. | Gold can be verified, but not easily. Verifying can require special knowledge, chemicals, or tools which aren’t available at every transaction. It is also not possible to verify how much gold exists or how much is actually in circulation. | The established rules of a Bitcoin transaction cannot be broken. A transaction will only take place if all strict requirements are met. It is not possible to counterfeit or create a ‘fake’ Bitcoin. |

| Medium | Weak | Strong |

Scarcity:

For money to function properly, it must be scarce and therefore rare. Similar to popular collectors items such as stamps or baseball cards, whenever you have more of something, the less rare it becomes and therefore less valuable. The failing scarcity is one of the keys to understanding why our dollar as we know it is effectively breaking down as good money. Inflation is the ultimate death sentence of a fiat currency and is a direct result of decreasing scarcity.

| U.S. Dollar | Gold | Bitcoin |

| The dollar is considered a fiat currency which means it is not backed or tethered to anything rare or physical. It can be created on demand with no effort or physical limitations. This means that the number of available dollars is effectively infinite which will continue to trend the value towards 0. | Gold is a natural rare earth element and very difficult to acquire more of it. It cannot be created artificially and therefore has a physical barrier in the supply. Scarcity and durability is what gives it value, not because of its intrinsic value for use in electronics. | Bitcoin is limited to a hard cap maximum supply of 21 million full units. The technical solution of how this is possible is one of Bitcoin’s greatest innovations. |

| Weak | Strong | Strong |

Summary

Based on the very definitions of what determines good money, Bitcoin clearly has an advantage by satisfying the most requirements. This is why ‘investors’ and the Bitcoin community are committed to believing it has value. Gold has a disadvantage because of portability. The dollar is arguably failing because of its weakness in scarcity. Bitcoin contains the best features of both gold and the dollar. It also contains other significant advantages over the other two including censorship resistance, decentralized control, and borderless transmission. Once we understand these fundamental monetary principles and how it solves them, Bitcoin has the potential to completely reshape economics as we currently understand it.

The only exception on the list is acceptability which is rapidly improving as adoption and acceptance of the asset increases around the world. Bitcoin has a self reinforcing network effect as more and more people elect to choose a monetary technology that best satisfies the underlying core requirements. Because of the underlying properties it possesses, people will continue to gravitate toward it simply because it functions better than all other options.

Volatility is also a major concern of many nervous prospectors, but short term volatility doesn’t change the underlying properties or fundamentals of what it is or how it works. As adoption and acceptance increase, the market size will eventually absorb major fluctuations which should decrease this current early stage volatility. Short term volatility is always negligible compared to long term performance and fundamentals.

And consider this: If Bitcoin was to remain at a fixed or constant price, human intervention would be required to constantly modify and influence the issuance and value to meet market “expectations”. The very essence of Bitcoin is that no human or entity controls the issuance or value outside of pure unobstructed market demand. Volatility is inherently expected in this new asset because of its rawness and ability not to be compromised by human intervention.

Not only has Bitcoin proven to be an excellent store of value in just over a decade, it is also quite possibly the best money the world has ever seen. Because it strongly satisfies so many requirements of good money, Bitcoin absolutely has value.

-Howard Minor